What is a Blockchain?#

Bitcoin and Blockchain#

You might be familiar with

Bitcoin

, which is one of the first protocols to utilize the revolutionary blockchain technology. The Bitcoin Whitepaper, authored by the pseudonymous

Satoshi Nakamoto

, described how Bitcoin could facilitate peer-to-peer transactions within a decentralized network using cryptography. This gave rise to censorship-resistant finance and presented

Bitcoin

as a superior digital store of value, often referred to as

digital gold

. There is a fixed amount of Bitcoin, similar to the scarcity of gold. You can learn more about this in the

.

Ethereum and Smart Contracts#

A few years after Bitcoin’s creation, Vitalik Buterin and others founded

Ethereum

, which builds upon the blockchain infrastructure, but with additional capabilities. With Ethereum, you can create decentralized transactions, organizations, and agreements without a centralized intermediary. This was achieved through the addition of

smart contracts

.

Though the concept of smart contracts was originally conceived in 1994 by

, Ethereum made it a reality.

Smart contracts are a set of instructions executed in a decentralized way without the need for a centralized or third party intermediary.

Smart Contract functionality is the primary difference between blockchains like

Ethereum

and

Bitcoin

. Technically

Bitcoin

does have smart contracts but they’re intentionally

turing incomplete

.

The Oracle Problem#

However, smart contracts face a significant limitation – they cannot interact with or access data from the real world. This is known as the

Oracle Problem

.

Blockchains are deterministic systems, so everything happens within their ecosystem. To make smart contracts more useful and capable of handling real-world data, they need external data and computation.

Oracles serve this purpose. They are devices or services that provide data to blockchains or run external computation. To maintain decentralization, it’s necessary to use a decentralized Oracle network rather than relying on a single source. This combination of on-chain logic with off-chain data leads to

hybrid smart contracts

.

Note:

Chainlink#

is a popular decentralized Oracle network that enables smart contracts to access external data and computation. Chainlink is also blockchain agnostic - so it’s going to work with any chain out there.

Layer 2 Scaling Solutions#

As blockchains grow, they face scaling issues. Layer 2, or L2, solutions have been developed to address this. L2 solutions involve other blockchains hooking into the main blockchain, essentially allowing it to scale. There are two primary types of L2 solutions:

- Optimistic Rollups: eg. Optimism, Arbitrum

- Zero-Knowledge Rollups: eg. ZK Sync, Polygon ZK EVM

Don’t worry too much about this now. Once we understand how blockchains work ‘under the hood’, we’ll go further into Layer 2’s then.

Terminology#

You’re going to hear some terms used in this course (and the community as a whole) a little interchangeably. Maybe you haven’t heard these terms before. I hope this offers a bit of clarification.

- Common Terms

- Blockchain: In web3, a blockchain is a digital ledger that records transactions across many computers in a secure and decentralized manner. Each block contains a number of transactions, and every new block is linked to the previous one, forming a chain. This makes the data tamper-resistant. Example: Bitcoin’s blockchain records all BTC transactions.

- Oracle: Oracles in web3 are intermediaries that provide smart contracts with external data. They act as bridges between blockchains and the outside world, allowing smart contracts to execute based on real-world events and data. Example: A weather oracle provides data for a smart contract that triggers crop insurance payments based on rainfall data.

- Layer 2: Layer 2 solutions in web3 are technologies built on top of a blockchain (Layer 1) to improve its scalability and efficiency. These solutions handle transactions off the main chain, reducing congestion and fees, and then settle the final state on the main chain. Example: The Lightning Network for Bitcoin.

- Dapp (Decentralized Application): A Dapp is an application that runs on a decentralized network, typically a blockchain. It is powered by smart contracts and operates without a central authority. Dapps can serve various purposes, from finance to gaming. Example: Uniswap, a decentralized finance application.

- Smart Contract: In web3, a smart contract is a self-executing contract with the terms of the agreement directly written into code. They run on blockchains and automatically execute when predetermined conditions are met, without the need for intermediaries. Example: A smart contract for an escrow service.

- Hybrid Smart Contract: Hybrid smart contracts combine on-chain code (running on a blockchain) with off-chain data and computations provided by oracles. This allows the contracts to interact with data and systems outside their native blockchain. Example: A smart contract for insurance that uses real-world data (like weather or flight delays) provided by oracles.

- Ethereum/EVM (Ethereum Virtual Machine): Ethereum is a blockchain platform known for its smart contract functionality. The Ethereum Virtual Machine (EVM) is its computation engine that executes smart contracts. Ethereum allows developers to build decentralized applications and is the basis for many web3 projects. Example: ERC-20 tokens, a standard for creating fungible tokens on Ethereum.

Web3#

Web3 is a term used to describe the new paradigm of the internet powered by blockchain and smart contracts. Unlike the previous versions of the web, web3 is permissionless and relies on decentralized networks rather than centralized servers. This ushers in an era of censorship-resistant and transparent agreements and transactions, often called an ownership economy.

Web1:

The permissionless open sources web with static content

Web2:

The permissioned web, with dynamic content where companies run your agreements on their servers.

Web3:

The permissionless web with dynamic content.

- Decentralized censorship reesistant networks run your agreemeent and code.

- User owned ecosystems where one owns a portion of the protocol they interact with - instead of solely being the product

Wrap Up#

We’ve taken a high-level view of the blockchain landscape, including its history and the problems that smart contracts solve.

At this point you might be asking yourself

what do these smart contracts really mean?

or

what is meant by trust minimized agreements/unbreakable promises?

In my mind a technology is really only as good as the problem it solves. So next, we’re going to look at what the

purpose

of

smart contracts

is - what’s the value proposition exactly?

Purpose of smart contracts#

The Essence of Blockchain and Smart Contracts#

Almost every interaction or transaction in our lives involves some form of agreement or contract. For instance, purchasing a chair involves a contract to buy lumber, assemble it, and sell the finished product. Your electricity supply is also based on an agreement between you and the electric company. When you get an oil change for your car, you’re promised a service in exchange for money.

Almost everything we do in modern life relates to an agreement or contract in some way.

To make it more relatable, think of contracts and agreements as promises. Traditional contracts, however, require trust between parties, and this doesn’t always work in favor of honesty and fairness.

The Problem with Traditional Agreements#

Lets consider some real world examples of where trust leverages agreements can go wrong and why blockchain technology and smart contracts mitigates these risks.

Consumer Trust#

In the 80s and 90s, McDonald’s Monopoly game promised customers a chance to win money through game cards obtained with purchases. However, it turned out that the game was rigged by insiders who manipulated the system for their gain. Essentially, McDonald’s failed to keep its promise.

This example demonstrates that relying on trust within agreements can lead to fraudulent activities and broken promises.

With smart contracts, we can eliminate the need for trust. A smart contract is an agreement or a set of instructions that are deployed on a decentralized blockchain. Once deployed, it cannot be altered, it automatically executes, and everyone can see its terms.

Imagine if McDonald’s Monopoly game was operated on a blockchain through a smart contract. The fraudulent activities would have been impossible due to the immutable, decentralized, and transparent nature of smart contracts.

Banking and Trust#

Traditional banks have sometimes failed to keep the promise of safeguarding people’s money, as seen during the Great Depression. Blockchain and smart contracts can ensure transparency and execute automated solvency checks, preventing the bank from becoming insolvent.

The core of blockchain and smart contracts lies in creating a trustless system where agreements are transparent, unchangeable, and executed without human intervention. This technology holds the potential to revolutionize industries and everyday agreements by ensuring honesty and fairness.

Financial Markets Access#

Centralized bodies, like traditional exchanges, have the power to restrict access to financial markets. This was evident when Robinhood restricted trading on certain assets in 2021. With decentralized exchanges like Uniswap, there is no central authority that can alter or limit market access. This introduces fairness and openness to the financial markets.

To Summarize#

- Traditional Agreements: Require trust in a centralized entity.

- Smart Contracts: Transparent, decentralized, and tamper-proof.

In a scenario where you have to choose, smart contracts are an obvious choice as they cannot be manipulated or altered in anyone’s favor.

Smart contracts are

the

solution to minimizing the reliance on trust based systems that have historically failed us time and time again.

Under the Hood#

Smart contracts are relatively new, but have already started transforming various markets. They do this by representing ‘promises’ as code on the blockchain. This code is executed by a decentralized collective, such that no single entity can alter the agreemeent in any way! The agreement and it’s terms are public knowledge and will automatically execute without human intervention.

More industries are adopting smart contracts and blockchain due to the numerous advantages they offer. This results in trust-minimized agreements or what can be simply termed as unbreakable promises.

Beyond Trust Minimization#

It is important to note that blockchain, smart contracts, and cryptocurrencies are not just about trust-minimized agreements. They offer security benefits, uptime advantages, execution speed, and

much more

.

Caution: Not All Are Equal#

However, beware of platforms that claim to be decentralized but are not in practice. An example from 2022 is the

SBF's FTX platform

. It presented itself as a Web3 platform, but was essentially a traditional Web2 company using cryptocurrency without the benefits of smart contracts.

As an emerging developer or user in this space, it’s important to discern between legitimate projects and those that aren’t contributing to the ethos of Web3. I want you to be successful, but I want you to be successful because you’re creating value. Platforms like

FTX

were pretending to bring value to the space and leeching value from it.

Wrap Up#

What we’ve learnt is that traditional contracts or agreements between parties are almost always trust based. Trust based agreements come with inherent flaws and the potential of broken agreements, the conseequences of which we’ve seen throughout history - The Great Depression, Monopoly Lottery, Robin Hood etc.

Blockchain technology and smart contracts solve these problems by introducing fairness, transparency and immutability to promises. These attributes of smart contracts assure that trust isn’t required and we can be certain that an agreement will be executed as described 100% of the time.

Lastly, it’s important to note that there are several actors, such as

FTX

which

pretend

to embody the ideologies of Web3, but are really centralized entities looking to extract value from the system, be aware of these.

Current smart contract landscape#

Features of Smart Contracts#

Smart contracts come with various features that distinguish them from traditional agreements.

Decentralization#

The first feature is decentralization; smart contracts do not rely on any centralized intermediary. Instead, they run on a blockchain which is maintained by thousands of individuals known as node operators. It’s the collective effort of these node operators running the smart contracts that make the network decentralized. This aspect will be discussed more in-depth later.

Transparency and Flexibility#

Transparency is inherent to blockchain networks. Since all node operators can see everything happening on-chain, there is no room for unfair or hidden deals. This transparency ensures that everyone has access to the same information and plays by the same rules.

It is important to note that this transparency does not necessarily compromise privacy. Blockchain is pseudo-anonymous, meaning that your transactions are not directly tied to your real-world identity.

Speed and Efficiency#

Smart contracts and blockchain transactions are incredibly fast and efficient compared to traditional banking systems. For example, bank transfers, especially international ones, can take up to several weeks, whereas blockchain transactions happen almost instantly. This speed is not only convenient but also allows for more efficient interactions between parties.

Security and Immutability#

Once a smart contract is deployed, it cannot be altered or tampered with. This immutability ensures that the terms of the contract are set in stone. This is a stark contrast to centralized systems where a server or database can be hacked, and data can be altered. The decentralized nature of blockchain makes hacking nearly impossible since an attacker would have to take control of more than half the nodes, which is significantly more challenging than compromising a single centralized server.

Additionally, the data on a blockchain is resilient. In a traditional system, if your computer and backups fail, you lose all your data. In contrast, in a blockchain, your data is replicated across thousands of nodes. Even if several nodes were to go down, your data would remain secure as long as there is at least one copy of the blockchain.

Elimination of Counterparty Risk#

Smart contracts eliminate the need for trust in transactions. Once a smart contract is deployed, its terms cannot be changed. This means that parties cannot alter the agreement based on greed or any other factors. This ensures that the agreement is enforced as originally intended.

In traditional systems, there is always a risk that the other party might not fulfill their end of the bargain. With smart contracts, this risk is eliminated, and agreements are enforced programmatically.

Applications of Smart Contracts#

Smart contracts have given rise to new industries and revolutionized existing ones.

Decentralized Finance (DeFi)#

DeFi, or Decentralized Finance, allows users to engage with financial markets without relying on centralized intermediaries. With smart contracts, users have transparent access to financial markets and can engage with sophisticated financial products efficiently and securely. We will provide practical examples of how to build and interact with DeFi protocols in upcoming lessons.

Decentralized Autonomous Organizations (DAOs)#

DAOs are governed entirely by smart contracts and operate in a decentralized manner. This structure offers benefits such as transparent governance, efficient engagement, and clear rules. DAOs are an evolution in politics and governance, and we will cover how to build and work with DAOs in future lessons.

Non-Fungible Tokens (NFTs)#

NFTs, or Non-Fungible Tokens, can be thought of as digital art or unique assets. NFTs have created new avenues for artists and creators to monetize their work. We will also cover how to create and interact with NFTs in this course.

Other Applications#

And then, maybe

you’ll

be the one to discover the next iteration of smart contract applications!

How Blockchains work#

In this lesson, we’re going to break down blockchains, the process and the technology itself using a widely-praised and accessible demo available

.

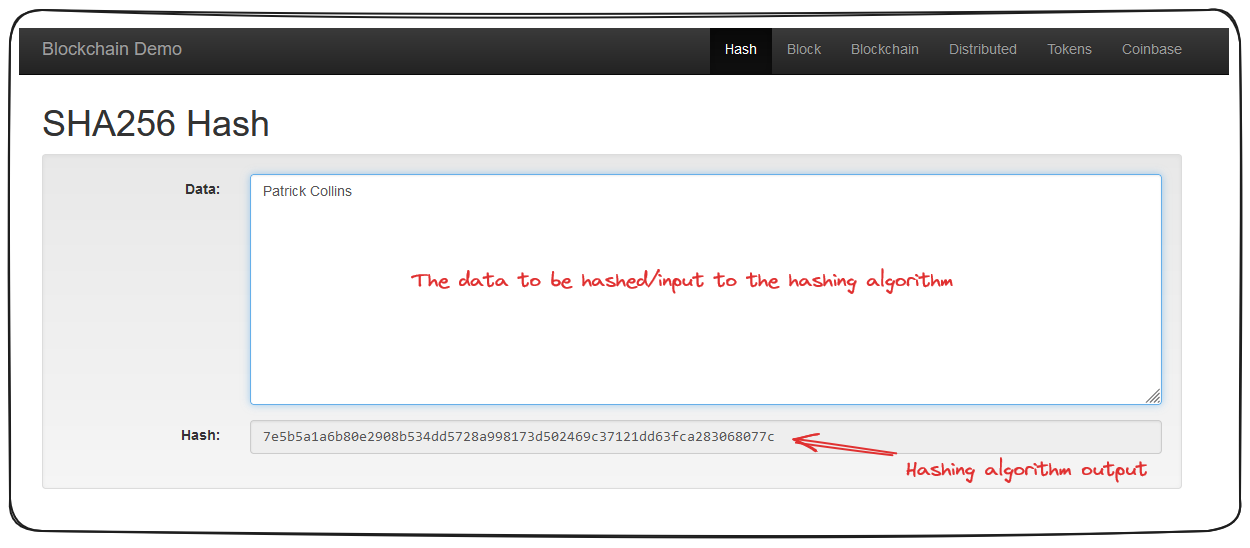

Understanding Hash Functions#

At its simplest, a hash is a unique, fixed-length string that serves to identify any piece of data. When you input any kind of data into a hash function, it produces a hash. In this demo, the hash algorithm we’ll focus on is SHA-256.

If I add

Patrick Collins

to our

SHA-256

algorithm, it will:

- Convert the letters to numbers

- Convert the numbers to a fixed-length “string” or “hash”

Patrick Collins

gets converted to

7e5b5a1a6b80e2908b534dd5728a998173d502469c37121dd63fca283068077c

Ethereum, uses its own version of a hashing algorithm (Keccak256)that isn’t exactly SHA-256 but belongs to the SHA family. This doesn’t change things significantly here as we’re primarily concentrating on the concept of hashing.

In the application, whatever data you enter into the data section, undergoes processing by the SHA-256 hash algorithm resulting in a unique hash.

For example, when I input my name as “Patrick Collins,” the resulting hash uniquely represents “Patrick Collins.” The fascinating aspect is, no matter how much data is input, the length of the generated hash string remains constant.

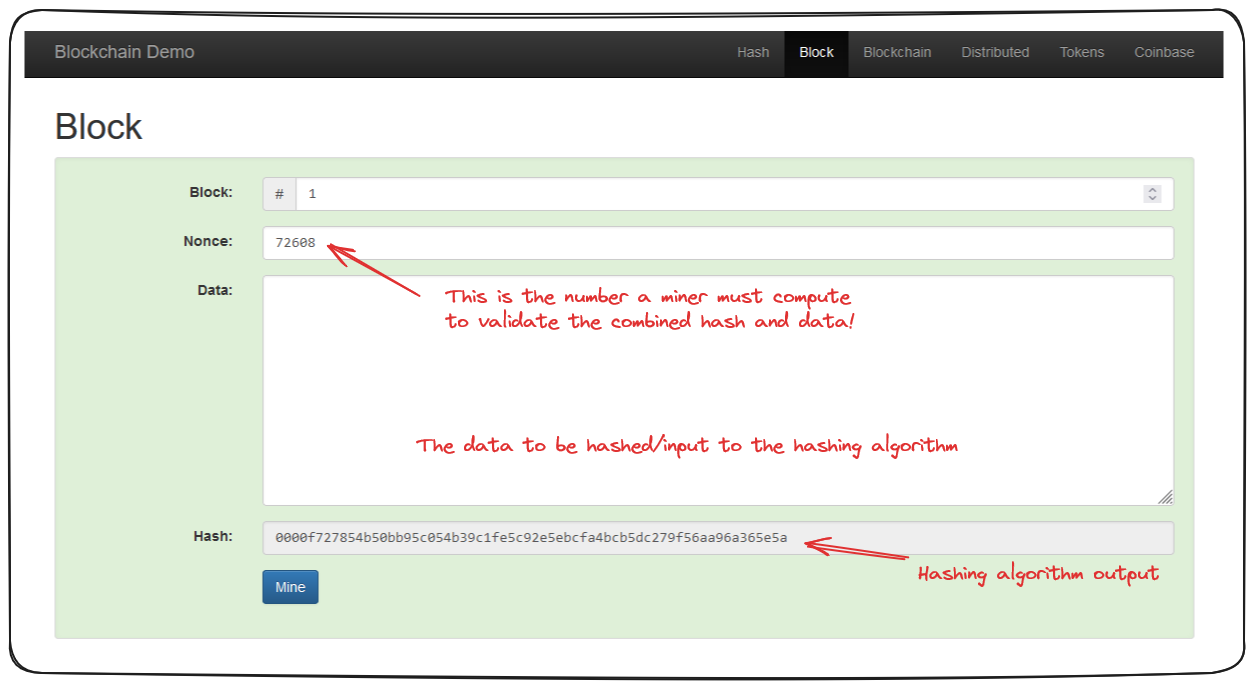

Understanding Blocks#

Now that we’ve grasped the concept of hashing and fixed-length string, let’s inspect the structure of a blockchain—a collection of “blocks.”

A block takes the same data input, but instead of a singular data field, a block is divided into ‘block’, ’nonce’, and ‘data.’ All three are then run through the hash algorithm, producing the hash for that block. As a result, even a minor change in the data leads to an entirely different hash, hence, invalidating the block.

In essence, mining involves the computational trial and error process of finding an acceptable value to produce a hash which typically follows a certain pattern, such as starting with four zeros. The value found, which satisfies this criterion, is known as the ’nonce’.

The problem or criteria a miner has to solve will vary from blockchain to blockchain, but the concept is the same.

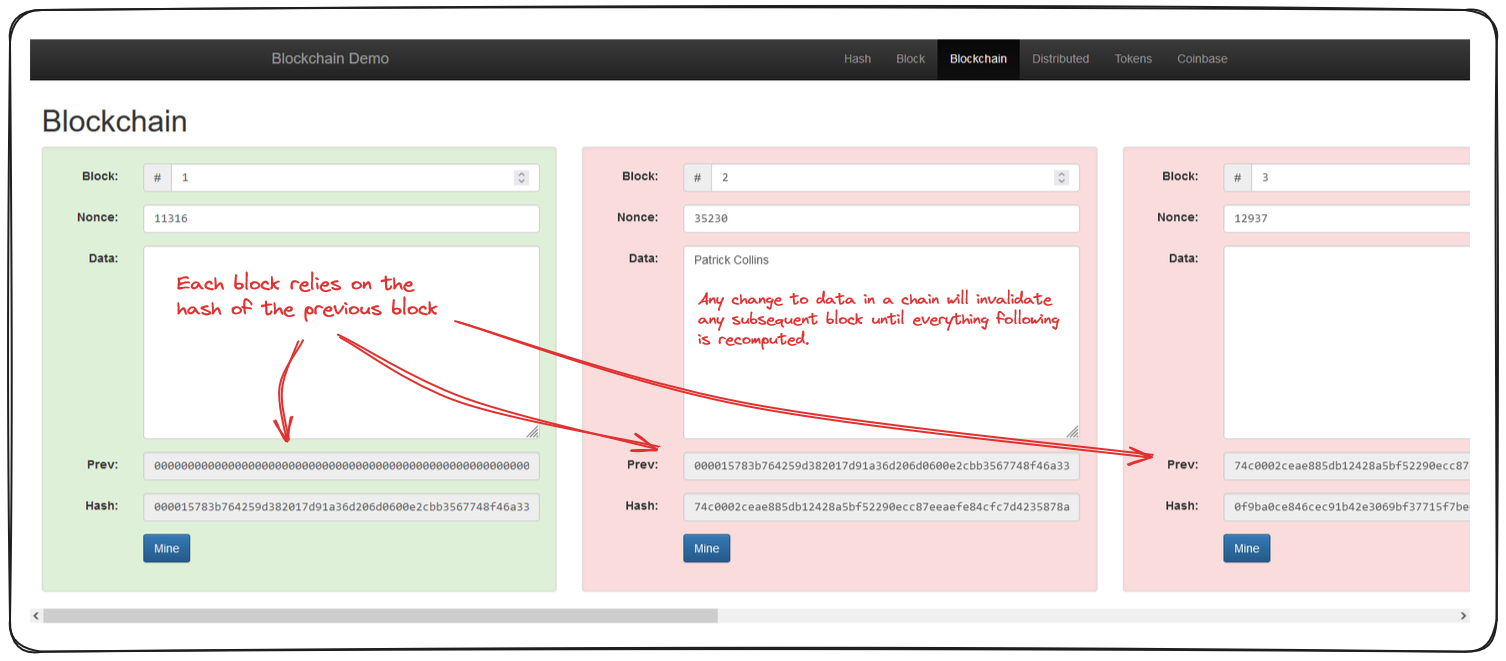

The Inherent Beauty of Blockchain: Immutability#

In a blockchain, which is essentially a sequence of blocks, each block is comprised of the previous elements - a block number, a nonce and data - as well as

the hash of the previous block

What this means in practice is that any changes to data, in any block of the chain, will invalidate every proceeding block, until they are recalculated, or re-mined.

Genesis Block:

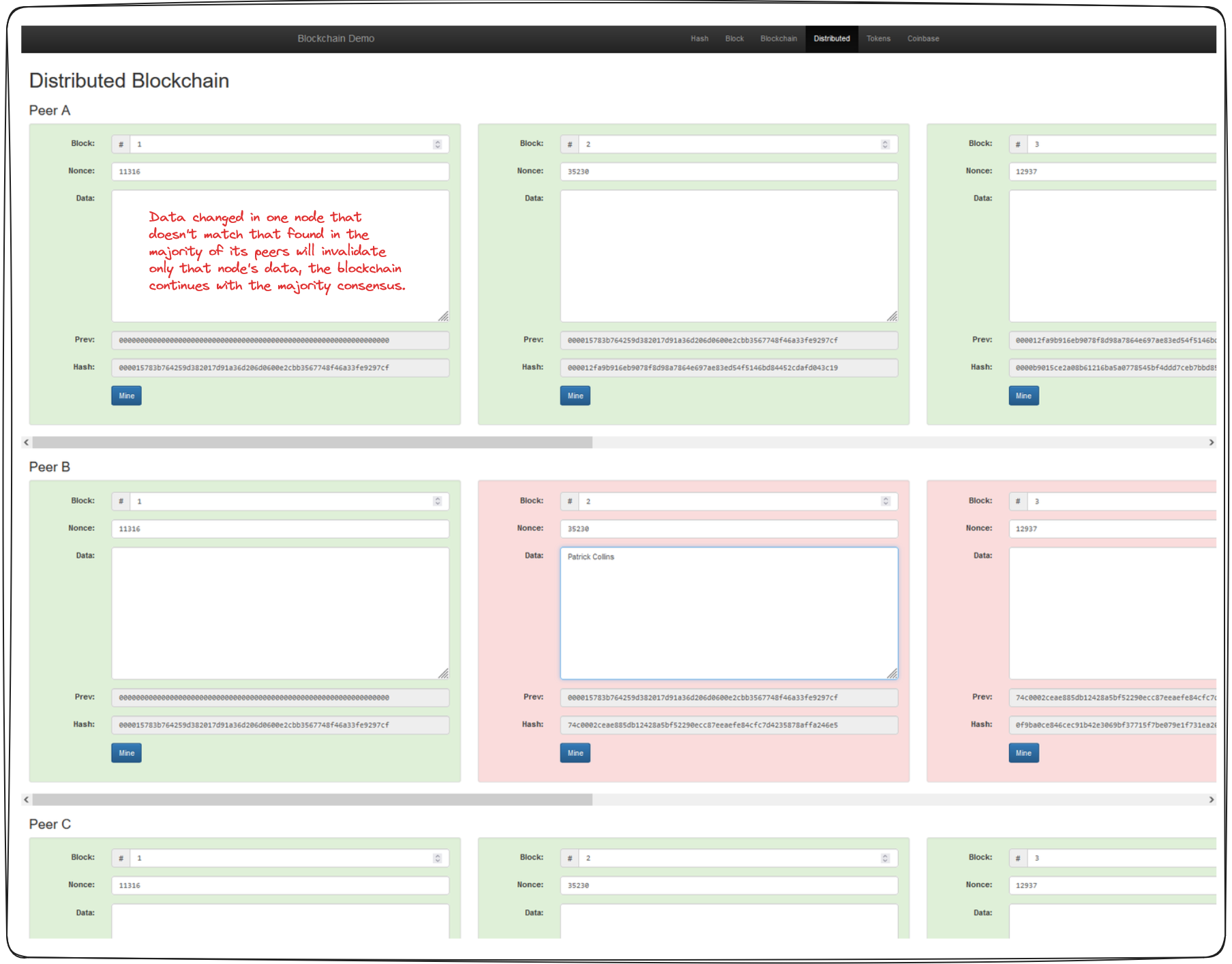

Decentralized Distribution#

Now, if a single entity were to control the blockchain, they could conceivably change any data they want, and then re-mine, or re-validate subsequent blocks. This is bad.

Enter Decentralized Distribution.

The crux of blockchain’s power lies in its decentralization or distributed nature. Under this system, multiple entities or “peers” run the blockchain technology, each holding equal weight and power. In the event of disparity between the blockchains run by different peers (due to tampering or otherwise), the majority hash wins, as the majority of the network agrees on it.

Nodes that don’t agree with the majority effectively fork the network, continuing on their own with their own history.

Interplay of Blockchain & Transactions#

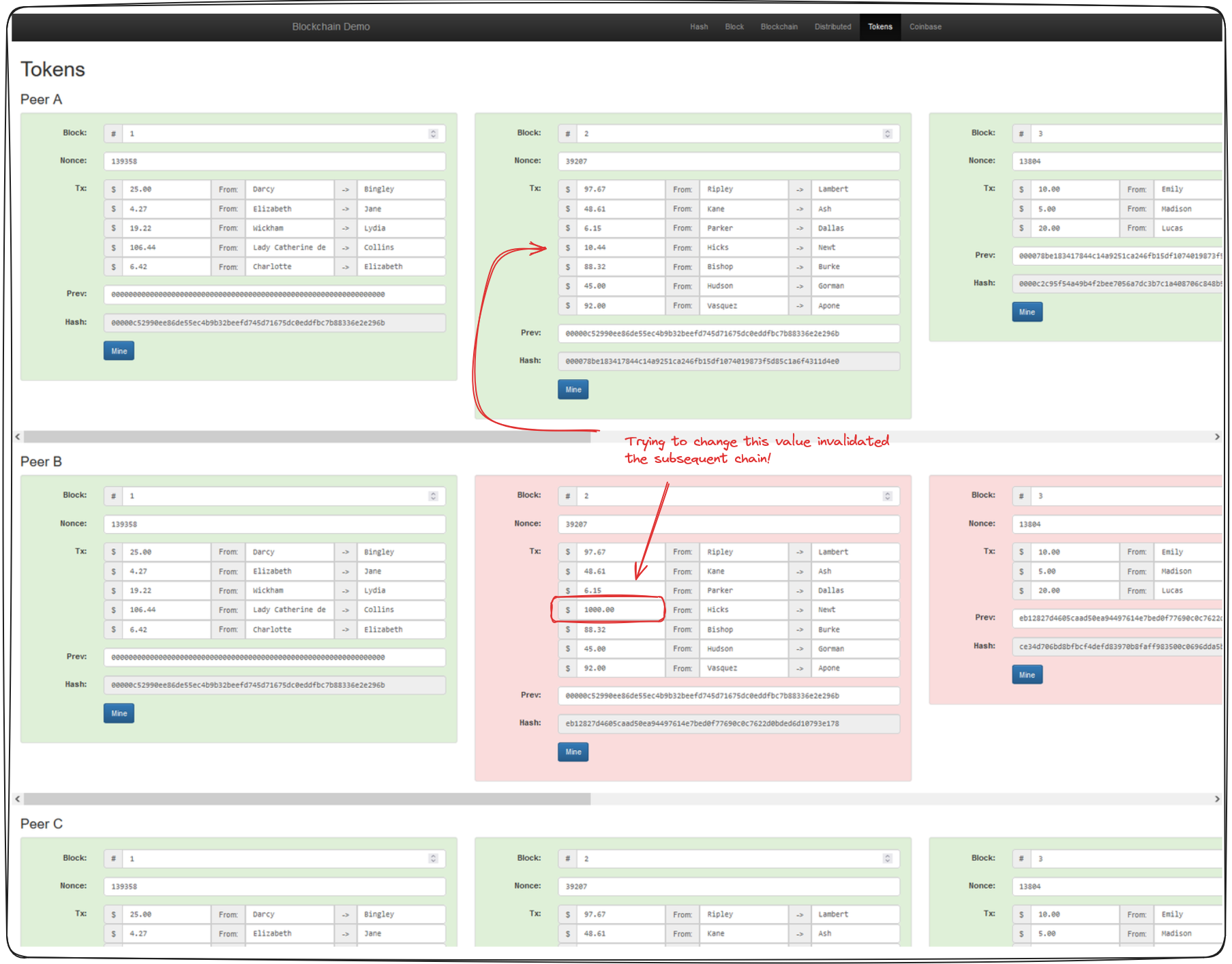

Until now we’ve been considering the data passed in a block to be a random string of text, but the reality is - this data can be anything. In the token and coinbase sections of this demo you can see how each block is comprised of a number of transactions that all get hashed together. Any edits to any of these transactions is going to invalidate the chain!

Wrap Up#

To summarize, every transaction, block, and indeed the whole blockchain itself comes down to understanding the concept of a hash—this unique fixed-length string that is intrinsically linked with the original data. We’ve also underscored the importance of decentralization and highlighted how the concept of immutability plays into the system’s security.

NB:

A nonce- is a “number used once” to find the “solution” to the blockchain problem.

A Block - is a list of transactions mined together

Mining - Process of finding the “solution” to the blockchain “problem”

Blockchain overview#

Preface#

I’ll start by saying, you’ve done great getting his far, if at first some of these concepts are hard to grasp, things will get better with experience as we move through the course and you’re exposed to real world examples.

I definitely would recommend going back and reviewing the parts that you don’t quite get and asking questions in the

of the GitHub repository.

Now that we know all the cryptography pieces, how the blockchain actually works, how our signatures work and how everything sticks together, let’s talk a little bit about how this works in actuality and what’s really going on.

It’s important to note that many of the concepts we’ve covered and will cover are going to pertain to Ethereum, or the EVM ecosystem. Each specific blockchain however, may have their own nuances and intricies to watch out for. Trust that the overarching concepts will all be the same, but keep an eye out for the specific criteria that may very from chain to chain, how blocktime is handled, or which hashing algorithm is used for example.

Traditional Networks vs Blockchain#

Traditionally, when you run an application be it a website or something that connects to a server you are interacting with a centralized entity. This is the opposite of what you may recall from our distributed blockchain example, in that the server is controlled and run by a single centralized group.

Blockchains, as we saw, run on a network of independent nodes. In our previous example, each of the

Peers

was representative of an independent

node

operator. The term

node

typically refers to a single instance of a decentralized system, Peer A would be a

node

. This network, this combination of these nodes interacting with each other is what creates a blockchain. What makes these networks so potent, is that anybody can join. All anyone needs is a little bit a hardward and you can participate in securing a blockchain network. You could go to GitHub and start operating a node in a few seconds!

In the traditional world applications are run by centralized entities and if that entity goes down or is malicious or decides that they want to shut off - they just can. They’re the ones that control everything.

Blockchains, by contrast, don’t have this problem. If one node or one entity that runs several nodes goes down, since there are so many other independent nodes running, it doesn’t matter, the blockchain and the system will persist so long as there is at least one node always running. Luckily for us, the most popular chains like Bitcoin and ethereum have thousands and thousands of nodes. Malicious nodes are kicked from the network, or even punished in some cases. Majority rules when it comes to the blockchain.

This gives blockchains this incredibly potent immutability trait where nothing can be changed or corrupted so in essence we can think of a blockchain as a decentralized database. In the case of Ethereum it has an extra additional feature where it also can do computation in a decentralized manner now.

Consensus#

Let’s talk consensus. This includes

Proof of Work

and

Proof of Stake

. You’ve probably heard these terms before and they’re really important to how these blockchains work.

The

mining

feature of our previous blockchain example was an example of

Proof of Work

Proof of Work

and

Proof of Stake

fall under this umbrella of

consensus

and

consensus

is a really important topic when it comes to blockchains.

Consensus

Very roughly, a consensus protocol in a blockchain or decentralized system can be broken down into two pieces a chain selection algorithm and a sybil resistance mechanism. Mining, or Proof of Work, is a sybil resistance mechanism. This is what Bitcoin currently uses.

Proof of Work

is known as a sybil resistance mechanism because it defines a way to figure out who is the block author or which node did the work to mine a block. Sybil resistance is a blockchain’s ability to defend against users creating a large number of pseudo-anonymous identities to gain a disproportionately advantageous influence over said system.

As mentioned, there are two primary types of sybil resistance:

- Proof of Work

- Proof of Stake

We’ll look a little closer at

Proof of Work

first.

Proof of Work#

Proof of work is a system of sybil resistance used in many blockchains, in its essence a miner needs to go through a very computationally heavy process (mining) to find the block’s answer. As a result, it doesn’t matter how many additional nodes you’re running, each node is obligated to do this work in order to receive a reward. The playing field is kept fair.

Note:

Proof of Work needs to be combined with a

chain selection rule

to create

consensus

.

A

chain selection rule

is implemented as a means to determine which blockchain is the

real

blockchain. Bitcoin (and prior to the merge, Ethereum), both use something called

Nakomoto Consensus

. This is a combination of Proof of Work (Etherum has since switched to Proof of Stake) and the

longest chain rule

.

In the

longest chain rule

, the decentralized network decides that whichever chain has the most number of blocks will be the valid, or

real

blockchain. When we saw

block confirmations

in Etherscan earlier, this was representing the number of blocks ahead of our transaction in the longest chain.

You’ll sometimes hear people use

Proof of Work

and

Proof of Work

also serves as a means to determine who receives transaction fees as we discussed earlier. These transaction fees are paid by whomever initiates the transaction. In a Proof of Work system, every node is competing against eachother to solve the block problem first. The first node to solve the problem gets paid the transaction fees accumulated in the block they mine. In addition to this, miners are also paid a

block reward

, the

block reward

is given by the blockchain itself.

If you’ve previously heard of the Bitcoin Halving - this is the concept of the block reward being cut in half roughly every 4 years.

Block rewards are in the blockchains native currency - Bitcoin = BTC, Ethereum = ETH. This effectively increases the amount of that cryptocurrency in circulation.

Blockchain Attacks#

There are two major types of attacks that exist in the blockchain space.

- Sybil Attack - When a user creates a number of pseudo-anonymous accounts to try to influence a network.

- 51% attack - Occurs when a single entity possesses both the longest chain

and majority network control. This would allow the entity to

forkthe chain and bring the network onto the entities record of events, effectively allowing them to validate anything.

Blockchains are very democratic. The bigger a blockchain is, the more decentralized, the more secure it becomes.

I encourage you to look into running a node yourself to increase the security of the network!

Proof of Work does come with drawbacks. For example, Proof of Work consumes a LOT of electricity. When you have thousands of nodes all working as hard as they can to solve a block problem the energy consumption is HUGE and as such, so is the potential environmental impact.

With the above in mind, many protocols are choosing the shift to a different consensus mechanism that is more environmentally friendly. The most popular of which is…

Proof of Stake#

In contrast to trying to solve a block problem, Proof of Stake nodes put up some collateral that they are going to behave honestly aka they

stake

. If a node is found to be misbehaving, it’s stake is slashed. This serves as a very effective sybil resistance mechanism because for each account, the validator needs to put up more stake and misbehaving risks losing all that collateral.

In a Proof of Stake system,

minersvalidators

Unlike in Proof of Work, where each node is racing to solve the block problem first, in Proof of Stake, validators are pseudo-randomly chosen to propose the next block and other nodes will validate it.

Proof of Stake of course comes with its own Pros and Cons.

Pros:

- great sybil resistance mechanism

- great for the environment, much less energy

Cons:

- seen as less decentralized due to upfront staking costs

This raises the question of

how decentralized is decentralized enough?

and I think I need to leave that to the community to decide.

Layer 1 and Layer 2#

I want to briefly touch on the concepts of Layer 1 and Layer 2 networks here as well.

Layer 1solutions: This refers to base layer blockchain implementations like Bitcoin or Ethereum.Layer 2solutions: These are applications added on top of a layer one, like Chainlink or Arbitrum.

Layer 2s like Arbitrum and Optimism are special in that they’re trying to solve the problem of scalability. These protocols leverage something called

rollups

. We won’t go too deep, but the idea is that the protocols bundle their transactions to be processed by a Layer 1.

Wrap Up#

This overview was huge. Amazing work, you now have a fundamental understanding of how blockchains work, how to interact with them and why they’re so secure and empowering.